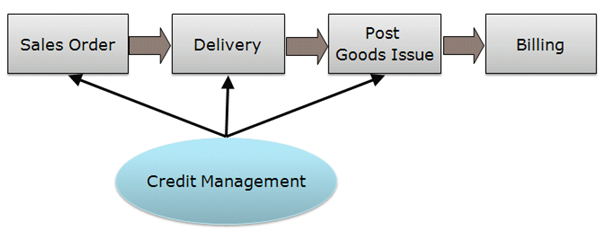

Credit management in SAP SD helps companies control how much credit they give to their customers. If you give too much credit it can be risky and cause money problems. SAP SD Course teaches you how to manage credit limits and monitor customers’ credit efficiently. Companies can set rules about how much each customer can buy on credit and when to block orders if the limit is crossed. You can also track customer payments and check if they are paying on time. Credit management ensures companies can sell safely and reduce losses. If you want to learn credit management step by step you can join a SAP SD Course.

Why Credit Management is Important?

Credit management is very important for all businesses. It helps avoid money losses and keeps the cash flow steady. Without proper credit rules customers can buy more than they can pay. SAP SD allows setting rules for each customer based on their payment history and risk level. Companies can monitor overdue invoices and take action when needed. Proper credit management builds trust between the company and the customer. It also helps sales teams decide which orders can be processed quickly and which need approval. Learning these skills is useful if you are starting your career in SAP SD Training in Noida.

Key Features of Credit Management

Credit management in SAP SD has several key features. Companies can define credit limits for each customer. You can check customer credit before processing orders. SAP SD also allows monitoring credit exposure in real time. There is a way to block orders when the credit limit is reached. Alerts can be sent to managers to review critical accounts. Credit rules can be different for domestic and international customers. Reports can be generated to see credit risk and customer payment behavior. These features make credit management simple and reliable.

Steps to Implement Credit Management

Implementing credit management starts with defining credit control areas. You set credit limits for customers and assign rules for order approval. Customers’ payment history is also added to help decide risk levels. SAP SD allows configuring automatic checks during order creation. The system can stop orders from being processed if the limit is exceeded. You can also create reports to review overdue invoices and take action. Regular monitoring helps keep credit risk low. Companies can train employees to use these tools effectively for safer sales.

Example: Customer Credit Limit

| Customer Name | Credit Limit | Current Credit Used | Status |

| ABC Traders | 50000 | 30000 | Safe |

| XYZ Enterprises | 100000 | 110000 | Blocked |

| PQR Pvt Ltd | 75000 | 50000 | Safe |

| LMN Corp | 60000 | 65000 | Blocked |

This table shows how credit management tracks which customers are within limits and which ones are blocked.

Credit Reports and Benefits

Credit management allows generating detailed reports. You can see total credit used, overdue payments, and credit exposure. The reports help managers take action before problems happen. Using reports reduces risk and improves cash flow. Companies can also analyze which customers pay on time and which cause delays. SAP SD makes it easy to update credit rules based on report findings. This keeps the business safe and improves customer relationships.

Learning Credit Management

You can learn credit management by joining a SAP SD Course in Pune. Pune has good institutes and trainers who can help you understand the tools in practice. Students can get hands-on experience with credit management settings.

You can also take a SAP SD Certification after learning. The certification proves your skills in managing credit and SAP SD processes. It also helps you get better job opportunities in companies that use SAP SD.

Conclusion

Credit management in SAP SD is useful for keeping sales safe and cash flow healthy. It allows companies to control customer credit and monitor payments. Learning credit management skills through a course can help you work confidently in real projects. Using reports and rules makes credit risk low. Cities like Pune offer training that helps you understand the topic practically. A certification in SAP SD Training in Hyderabad strengthens your career prospects and shows you are skilled in credit management.