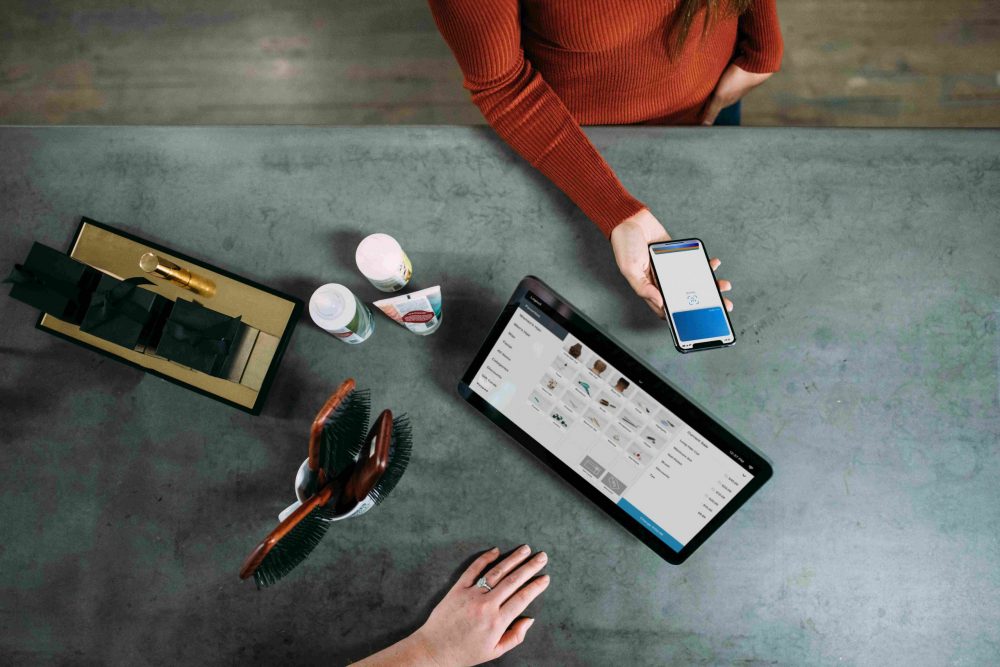

When I built up my first online store, I didn’t think much about how to handle payments. But when sales started coming in, my account started having problems with failed transactions, customer complaints, and late payments. It made me realize how important it is to have the right Payment Gateway.

In this article, I’ll talk about what I went through, what I learnt, and why every firm should carefully choose its payment gateway.

We lost sales till we fixed our payment system.

Almost 20% of our customers used to take their carts away at the last step. Most of them were ready to buy, but the payment didn’t go through. We found a number of explanations after researching into it:

Limited compatibility of payment gateways with cards from other countries

- No support for mobile transactions

- Bad load times when there are a lot of people online

- A confusing or irregular checkout process

The situation was better quickly after we switched to a better Payment Gateway, and we witnessed a 30% drop in refund requests.

Your Gateway Should Be as Fast as Customers Expect

We saw that people who buy things now want them right away. This is what helped us make things faster and more reliable:

- Choosing a payment gateway that is always up and processes quickly

- Using APIs that work well on both desktop and mobile

- Getting rid of extra redirection throughout the payment process

- Checking transaction times on a regular basis

- Customers won’t accept sluggish payments any more than you would accept slow shipments.

Having more than one payment option is important

We made a mistake at first by just letting people pay with credit cards. We didn’t know that so many people liked digital wallets, bank transfers, or even cash payments.

- Adding these choices made a big difference:

- Customers trust you more

- Less cart abandonment

- More mobile users who turn into customers

- Better customer satisfaction in different parts of the world

A flexible Payment Gateway lets businesses change their payment systems to fit the needs of different markets without having to start from scratch.

Why they were able to grow their business faster with the right gateway setup

A friend of mine who owns a business was having trouble expanding to other countries. Even though they did a good job of marketing, their conversion rate was low. We looked over their checkout configuration and saw that their Payment Gateway didn’t work with a lot of popular global methods.

After they made the changeover, their firm started to thrive in areas where it had been hard for them before. It turns out that their Payment Gateway was making it harder for them to reach more people. It might not be your goods or price; it might be how you take payments.

What I Look For Now When Picking a Payment Gateway

This is what I want in a Payment Gateway:

- Safety and following PCI rules

- How easy it is to work with other systems

- Support for many currencies and areas

- Technical help is available 24/7.

- Fees that are clear and no extra costs

- Dashboard for real-time reporting

- Timelines for quick settlement

Having a checklist provides us peace of mind and a better place to start than just trying things out at random.

One integration that made our jobs easier

We found Payfirmly while searching for a service that was easier to use and made it easier to handle payments. Their system was simple to use, and when we needed help setting it up, their support was quick.

Payment gateways help find and stop fraud.

We all know about chargebacks, credit card information being stolen, and fake transactions. It happened to us too until we started using a Payment Gateway that came with built-in features to stop fraud.

We were able to do these things with these tools:

- Find questionable activity on its own

- Stop high-risk transactions before they happen. Limit chargebacks that happen because of stolen cards.

- Keep an eye on transaction patterns and alerts

Why the Right Gateway Is Important for Subscriptions and Recurring Billing

When we first launched a subscription product, we felt it would be easy to add.We were mistaken. Not all payment gateways are good at handling recurring invoicing.

We have problems like:

- Auto-renewals that didn’t work

- Charges that are the same

- Sending customers emails that are hard to understand

- Cancellations need manual intervention

Those problems went away when we switched to a Payment Orchestration Platform that had more advanced billing choices. Subscriptions started to work better, and fewer customers left.

To sum up

In short, constructing a lot of e-commerce sites has taught me that a good payment gateway does more than just process payments. It also helps you grow, keeps you from getting into big IT problems, and builds trust with customers.

Don’t wait for irate customers to email you for payments to fail to find out how important it is. Make it a top focus from the start.