According to IMARC Group’s report titled “India Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034“, the report offers a comprehensive analysis of the industry, including India real estate market trends, share, growth, and regional insights.

How Big is the India Soft Drinks Industry?

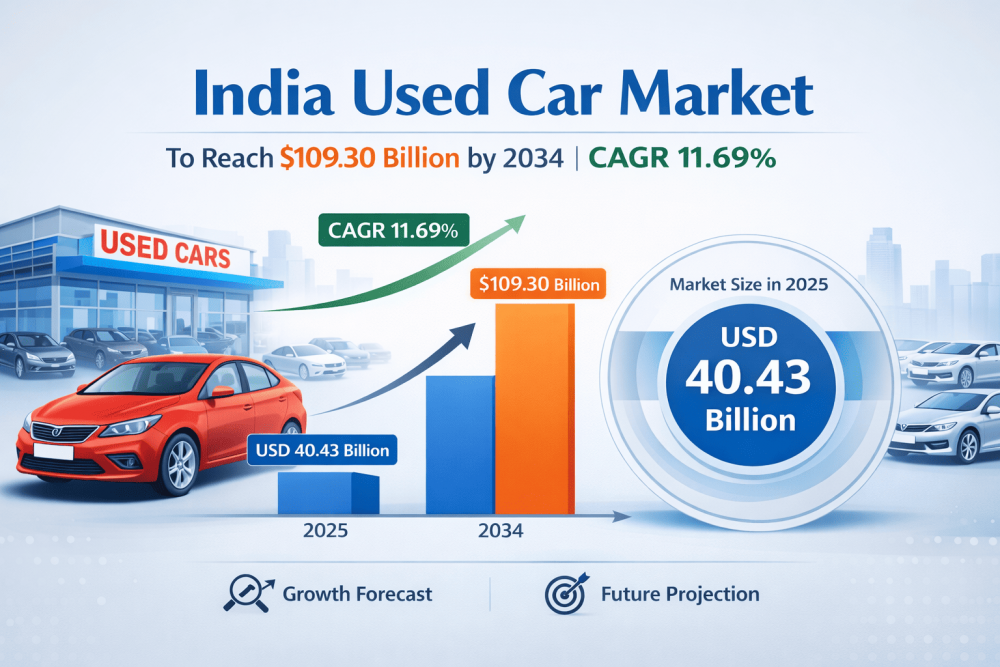

The India used car market size was valued at USD 40.43 Billion in 2025 and is projected to reach USD 109.30 Billion by 2034, growing at a compound annual growth rate of11.69% from 2026-2034.

Key Insights of the India Used Car Market

- Rising new car prices and higher costs due to taxes and emission norms make used cars a cost-effective alternative.

- India’s middle class is expected to nearly double to 61% of the population by 2047, fueling demand especially in Tier-2 and Tier-3 cities.

- Digital platforms and organized dealership networks have increased transparency, financing ease, and trust in used car purchases.

- The unorganized sector dominates with local dealers and brokers offering competitive prices and flexible negotiations.

- Hatchbacks hold the largest vehicle type market share due to affordability, fuel efficiency, and suitability for urban areas.

Sample Request Link: https://www.imarcgroup.com/india-used-car-market/requestsample

India Used Car Market Trends

The India Used Car Market is witnessing dynamic shifts as consumer preferences evolve and digital technologies redefine buying behaviors. A key trend driving this market is the rapid digital transformation of the sales ecosystem, with online platforms integrating advanced features like AI-powered pricing analytics, virtual vehicle tours, detailed vehicle histories, and instant financing options, resulting in more transparent and convenient purchase experiences for buyers. Consumers increasingly prefer certified pre-owned vehicles, valuing multi-point inspection reports and warranty coverage that reduce uncertainty associated with pre-owned transactions.

Additionally, organized dealerships are expanding into tier-2 and tier-3 cities, helping bridge accessibility gaps that previously restricted quality used vehicle availability outside major urban centers. Another notable trend is the strong market segmentation by vehicle type, with hatchbacks retaining a leading share due to their affordability and suitability for congested urban roads, while SUVs and premium pre-owned options gain traction among value-driven buyers who seek higher comfort and performance.

Moreover, gasoline vehicles continue to dominate sales, supported by extensive refueling infrastructure and consumer familiarity. In addition, offline sales channels remain significant as many buyers still prefer in-person inspections and test drives before committing to a purchase.

India Used Car Market Growth Factors

The scope and growth analysis of the India Used Car Market underscores a robust expansion trajectory fueled by affordability considerations, rising disposable incomes, and increasing demand for personal mobility solutions. According to IMARC Group, the market generated significant revenue in recent years and is expected to grow substantially, supported by evolving consumer lifestyles and broader adoption of pre-owned vehicles as practical alternatives to new car purchases.

Key growth drivers include rising new car prices that have created affordability gaps, prompting budget-conscious consumers to seek value in pre-owned options without compromising on features or quality. Moreover, enhancements in digital buying experiences—such as transparent pricing mechanisms and doorstep delivery—are expanding market reach among younger, tech-savvy buyers. The growing middle-class population across urban and emerging semi-urban regions is also contributing to sustained demand growth, as personal transportation becomes a priority amidst limited public transit options.

Additionally, partnerships between digital platforms and financial institutions are improving loan accessibility, reducing barriers to ownership for first-time buyers. Moreover, organized players are leveraging standardized inspection protocols and certified programs to build consumer trust, further strengthening market penetration. In addition, evolving infrastructure and improved road connectivity in smaller cities are creating new customer segments, making the India Used Car Market a resilient and scalable segment within the broader automotive industry.

India Used Car Market Segmentation

India used car market segmentation is by vehicle type, vendor type, fuel type, and sales channel as follows:

Vehicle Type Insights:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Sedan: Not explicitly described.

- Others

Vendor Type:

- Organized

- Unorganized

Fuel Type:

- Gasoline

- Diesel

- Others

Sales Channel:

- Online

- Offline

Regional Insights

North India is a dominant region in the used car market, driven by high personal mobility demand, urbanization, and rising disposable incomes. Cities like Delhi NCR enforce vehicle age restrictions, increasing demand for newer used cars. Wide range of local dealerships, favorable financing, and aspirational upgrades contribute to growth, supported by Tier-2 and Tier-3 city participation.

Recent Developments & News

- April 2025: Spinny raised $131M in a pre-IPO round led by Accel at a $1.7–1.8B valuation to expand its NBFC lending services and integrate acquired media titles including Autocar India. Spinny has $521M total funding and targets IPO readiness.

- March 2025: Spinny’s parent company, Value Drive Technologies, acquired Haymarket SAC, owner of automotive media brands Autocar India, Autocar Professional, and What Car? India.

- April 2025: CARS24 acquired Team-BHP, an auto enthusiast community, to merge community insights with its transactional marketplace.

- January 2025: Toyota Kirloskar Motor launched Toyota Mobility Solutions and Services India (TMSS), offering certified vehicles with extensive inspections and a “One Price for All” policy, with outlets in Bangalore, Delhi, and Guwahati. Plans nationwide expansion by 2030.

- February 2024: Zoomcar and CARS24 announced a strategic collaboration to support local hosts in car-sharing entrepreneurial ventures.

- December 2024: GST Council raised taxes on supplier margins for small used cars including EVs from 12% to 18%.

Key Players

- Big Boy Toyz Ltd

- BMW India Private Limited (Bayerische Motoren Werke AG)

- Cars24

- CarTrade.com

- Honda Cars India Limited (Honda Motor Co. Ltd.)

- Mahindra First Choice Wheels (Mahindra & Mahindra Limited)

- Maruti Suzuki India Limited (Suzuki Motor Corporation)

- OLX (OLX Group)

- Quikr India Private Limited

- Spinny (Valuedrive Technologies Private Limited)

- Toyota Kirloskar Motor Private Limited (Toyota Motor Corporation)

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.