When it comes to bitcoins, among the hardest tasks for shareholders to avoid is falling caught up in the hype. Cryptocurrency transactions have quickly risen to prominence in the hands of many banks and other financial institutions. Professionals, on the other hand, have continued to caution consumers about the stock’s erratic behavior.

If you’ve chosen to trade as in the cryptocurrency world, you might do your study before giving over any money, like any business. In the following subsections, we’ll go through the items you may know to invest.

Think about why you’re investing in cryptocurrencies.

Before I trade in bitcoin, the most crucial question which arises himself is what you’ve been doing. There are a few investment alternatives available at this moment (many of which offer more stability and less risk than digital currencies).

Are you interested mostly because of the present prevalence of the currency craze? Is there a compelling rationale for purchasing one or more specific digital tokens? Of course, various stakeholders may have different financial targets, and some may find it more beneficial to investigate the bitcoin space than many others. Once you figure everything out, you can create your Bitcoin Wallet and start trading.

Get a Glimpse of the Industry

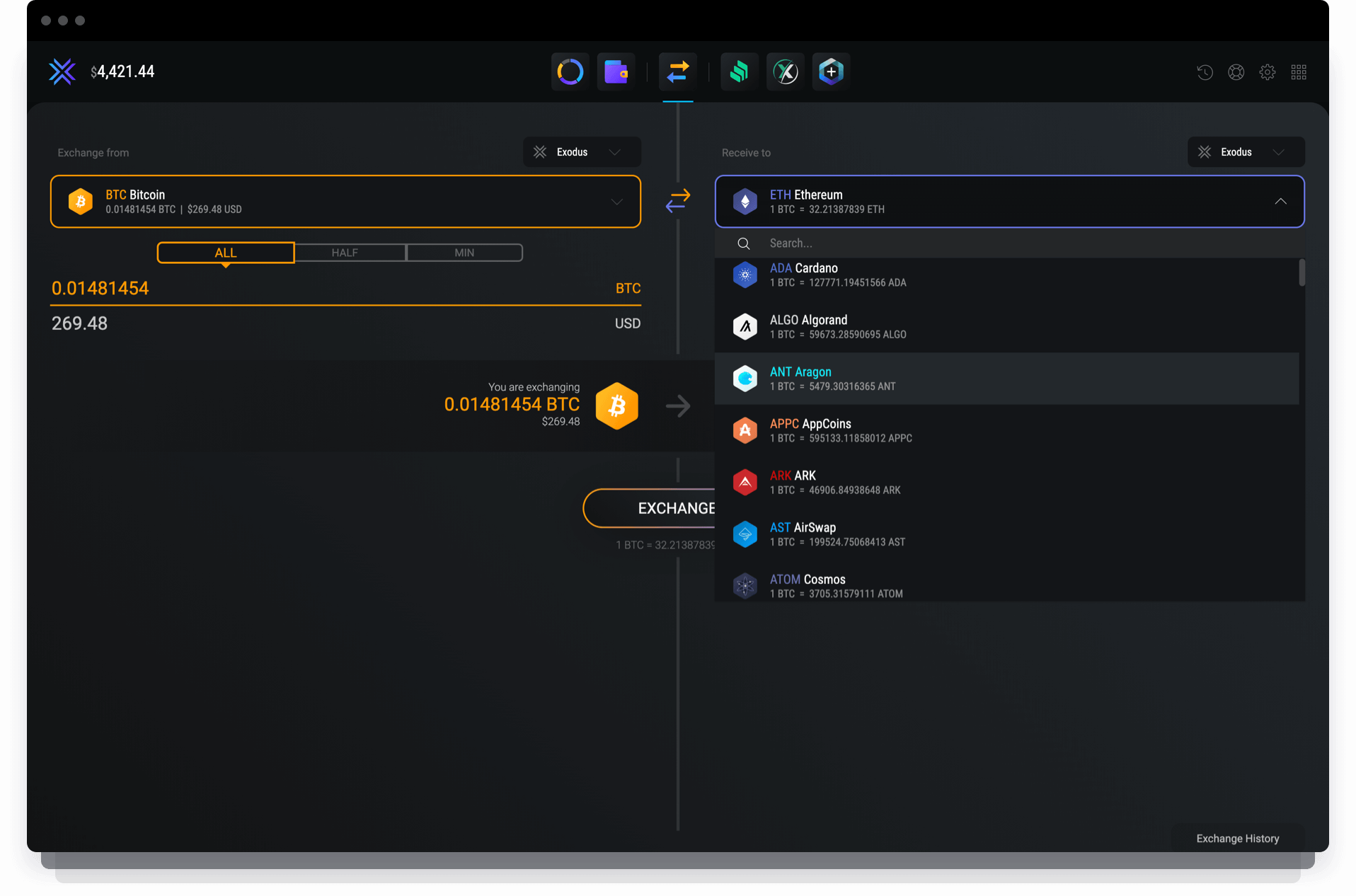

It’s vital to gain a sense of the how the influence of digital currencies works before investing, especially for newbies to the field. Take the time to become familiar with the many currencies provided. With hundreds of new currencies and tokens to select from, going beyond a very well names like Litecoin, Ether, and Ripple is crucial.

To realize how all this part of the bitcoin market works, it’s also necessary to learn about blockchain technology.

If you don’t have a background in computer science or coding, understanding some parts of blockchain technology will be difficult. There are a number of easy-to-understand primers on blockchain technology.

Once you’ve decided on a cryptocurrency (or multiple cryptocurrencies) to invest in, check into how those tokens utilise blockchain technology and whether they provide any unique features that set them apart from the competition. You’ll be better able to judge whether a possible investment opportunity is worthwhile if you have a deeper grasp of cryptocurrencies and blockchain technology. There have been a couple of safety concerns when investing in crypto, but most of the wallets use app shielding technology.

Join a Cryptocurrency Fanatics’ Online Community

Time moves at a fast rate in the cryptocurrency area because this is such a popular issue. Lot of it comes down here to the presence of a big and busy community of cryptocurrency investors and enthusiasts who connect with each other at the all hours of the day and night.

To keep up on what’s going on in bitcoin sector, join our community. Even though Reddit is a hub for cryptocurrency enthusiasts, there still are countless other online communities where discussions are occurring. Online communities are very useful also if you’re looking for mining, for example, Helium Mining.

White Papers on Cryptocurrency

The characteristics of a digital money, rather than word of mouth, are more significant. In deciding whether or not to invest, seek for project’s white paper. Every coin effort should have one, but it should become easy to locate (if it isn’t, that’s a red flag).

Read the white paper carefully; it should contain all you need to know about the project’s creators’ intentions, including a timetable, a basic summary, and specifics. It is often seen as a negative if the white paper lacks statistics and precise facts about the project. A development team’s chance to put forth the who, what, when, and why of their project is the white paper. If something in the white paper feels incomplete or deceptive, it might be a sign of larger problems with the project.

It’s All About the Timing

As a consequence won your thorough research, you’ve most likely developed an understanding of the bitcoin market and selected on maybe more ventures in which to contribute. The very next step is to figure out when the optimal time is to invest. The realm of digital currency is typically fragile and moves quickly.

On the one hand, investing in a hot new currency before its popularity and value skyrockets may encourage other investors to follow suit. In actuality, keeping a close eye on the industry before making a move will improve your chances of success. Cryptocurrency prices follow their own set of patterns. Bitcoin is often seen as the trailblazer among digital currencies, with others following suit. 1 Of course, news of an exchange hack, fraud, or price manipulation may send shockwaves across the crypto market, so keeping an eye upon what is going on, in general, is critical.

Finally, please note that investing in cryptocurrency transactions has a significant level of risk. For each instant bitcoin fortune, many more investors have poured money through into the imaginary token realm only to see it dissipate. Investing in this sector includes a risk. You might speed up this process by doing all research before investing.