A Triangle Pattern is the easiest sort of example to distinguish and set in motion. Understanding these triangle examples will empower a dealer to recognize the ascending pattern in the cost of a stock/list.

Any stock/list finishes an example that can be followed and dissected. There are various examples that a dealer has to know to settle on an educated choice on an exchange. To get going, Triangle Patterns are the easiest sort of examples to distinguish and set in motion. Understanding these triangle examples will empower a broker to detect the ascending pattern in the cost of a stock/file.

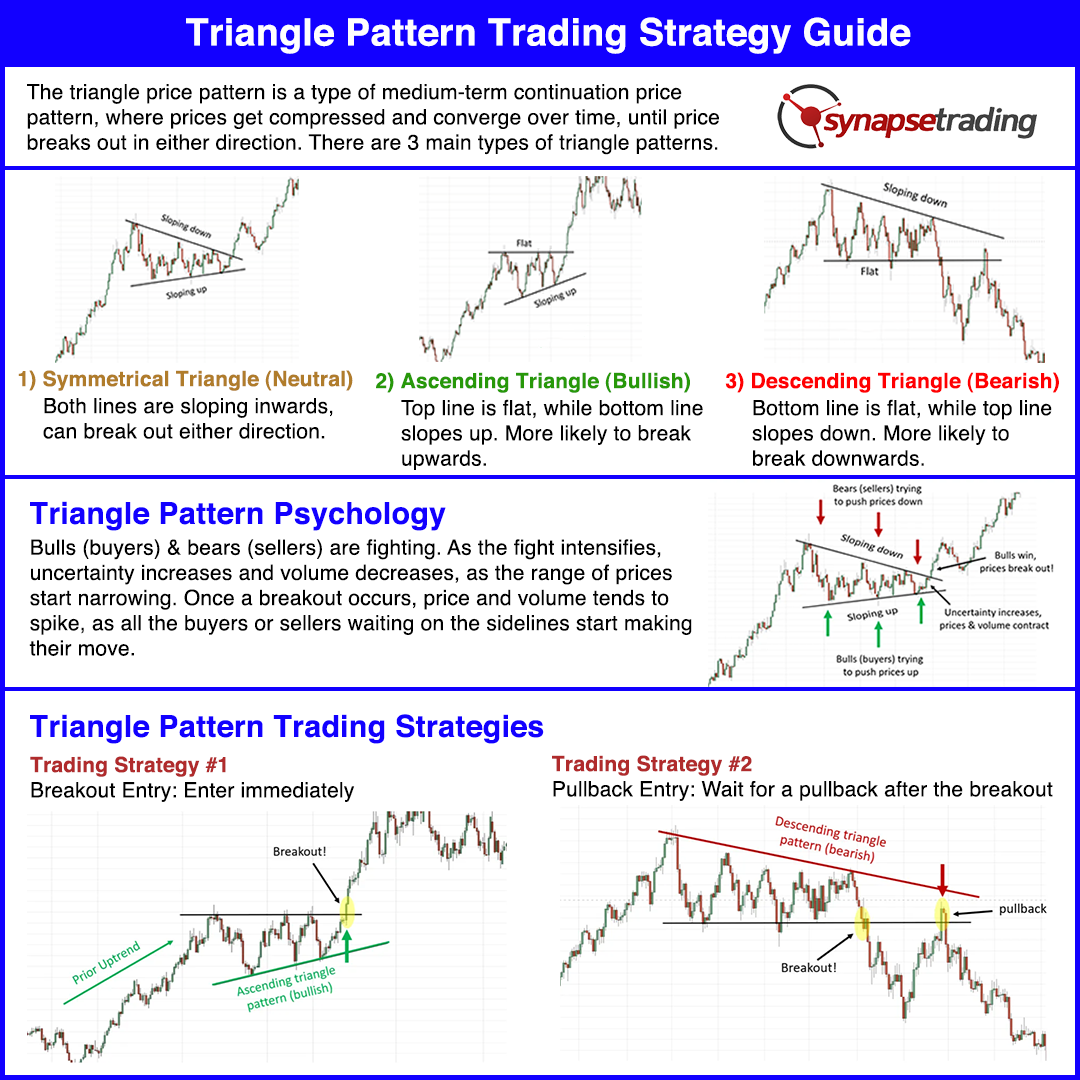

Different Types of Triangle Patterns

Triangles fall under the class of continuation design. For a triangle to be framed there must be a past pattern following which costs turn sideways. When this situation is set up, the triangles are shaped. They start from the greatest point and end at the tightest place of development.

Perceiving these examples is vital for any merchant. These examples are not difficult to recognize and they go about as a highlighter on the outlines showing an expected exchange.

Triangle Patterns can be isolated into three classes:

- Symmetrical Triangle

- Ascending Triangle

- Descending Triangle

Symmetrical Triangle:

A Symmetrical Triangle is framed when costs turn aimless or stock/list goes into a union stage. During this stage, costs begin contracting until both the declining pattern lines meet each other at a point called Apex. The result of this example can be regardless for example costs can either proceed with their past pattern and move higher or can opposite and separate bringing about an inversion of the pattern.

Ascending Triangle:

This example is typically found in an upturn and seen as a continuation design. The ascending triangle is framed with an ascending trendline that meets with a level even opposition line. This happens when costs make higher lows through various highs that are practically equivalent. What’s more, if it is found in a downtrend, an Ascending Triangle example ought to be focused on as it can go about as an amazing inversion design.

Descending Triangle:

This example is typically found in a downtrend of a stock/list. It is something contrary to an Ascending Triangle Patten. It is framed when costs make lower tops though different laws are practically equivalent. Whenever found in an upswing it ought to be focused on as it can go about as an amazing inversion signal.

Overconfidence bias: Why do we commit this error?

The vast majority will more often than not misjudge their abilities, regardless of whether it’s changing a plug or dealing with their funds.

In contributing, overconfidence bias frequently drives individuals to misjudge their comprehension of monetary business sectors or explicit speculations and negligence information and master counsel. This regularly brings about less than ideal endeavors to time the market or fabricate fixations in hazardous speculations they might think about a slam dunk.

What can be done?

The overconfidence bias can be countered in various ways. One beginning stage is to urge customers to account for the viewpoints of others, from relatives and companions to your monetary group. While we regularly misjudge our capacities, we will more often than not be truer while thinking about the choices of others.

Another system is to walk customers through past venture choices and talk about how they turned out. Illustrate, if relevant, how overconfidence prompted helpless results over the long run, and contrast these results and the outcomes the customer may have accomplished with a more sensible methodology.

At last, consider requesting that the customer play out a pre-mortem. This cycle, promoted by Nobel Prize-winning financial analyst and therapist Daniel Kahneman, includes envisioning likely results according to a future point of view—maybe 5 or 10 or 20 years down the line. Start by envisioning that the speculation methodology you’re thinking about has succeeded, and from this envisioned point, later on, consider every one of the reasons it has progressed nicely. Then, at that point, envision that a similar system has failed to meet expectations, and thoroughly consider every one of the reasons it hasn’t made progress. This activity might assist individuals with seeing possible dangers and stumbles that they may have disregarded in their exorbitant hopefulness.

Making these strides can assist with shielding customers from settling on helpless venture choices. What’s more, that, thus, can fabricate a more profound well of trust and fortify your counsel customer relationship.