Step by step instructions to Invest in Cryptocurrencies Beginners Guide

On the off chance that you need to purchase digital currency rapidly and effectively with your Visa look at the Kraken Exchange!

Cryptographic forms of money have essentially been a subject of extraordinary conversation in the course of the most recent couple of years. How often have we heard accounts of individuals getting for the time being moguls and, simultaneously, accounts of individuals who lost countless dollars planning to make a snappy buck?

Thus, in the event that you are hoping to put resources into crypto in a protected way, at that point this guide is for you. The motivation behind this guide is to help instruct financial specialists however much as could be expected and to decrease theory on the lookout.

On the off chance that you need to become familiar with digital currencies themselves, at that point you can look at our tenderfoot seminars on cryptographic forms of money.

Disclaimer prior to proceeding: We are not a budgetary foundation: All we are demonstrating is instructive material: Do not accept this data as expert venture guidance.

Instructions to Invest in Cryptocurrencies 101

The very actuality that you are perusing this guide shows us that you are keen on putting resources into digital currencies. These unchanging and replaceable cryptographic symbolic vows to turn out to be hard and non-manipulatable cash for the entire world. Their promoters see a future where Bitcoin or different cryptographic forms of money will substitute Euro, Dollar, etc and make the primary free and hard world cash.

Other than what was at that point stated, there are three significant valid justifications to put resources into digital forms of money.

To begin with, on the grounds that you need to support your total assets eventually. Second, since you uphold the social vision behind digital currencies – that of free and hard cash for the entire world. Third, since you comprehend and like the innovation behind it.

In any case, there are likewise extremely awful motivations to put resources into cryptographic forms of money. Numerous individuals succumb to the publicity encompassing each digital money bubble. There is consistently someone caught by FOMO (dread of passing up a major opportunity), purchasing greatly in at the pinnacle of an air pocket, just in the would like to bring in snappy cash, while not understanding digital forms of money by any means. That is a terrible explanation. Try not to do this. Learn before you contribute.

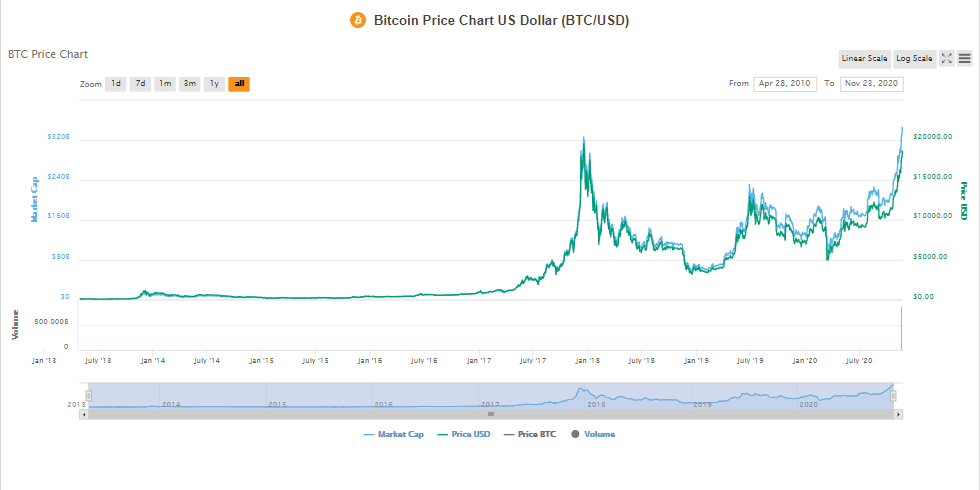

Beginning phase speculators in Bitcoin and Ethereum made large number of dollars in unadulterated benefits. In the event that you see the accompanying chart, at that point you will know precisely what we mean.

In a one-year interval of time from December 2016 to December 2017, Bitcoin went from $750 to a faltering $20,000! This implies that anyone who put $10,000 in December 2016, would get back a psyche desensitizing $216,997 in precisely 365 days. Truth be told, the complete market cap of digital forms of money went as far as possible up to a shocking $630 billion before the finish of 2017.

In any case, as an ever increasing number of theorists overwhelmed the market, the unavoidable occurred.

The market took a tremendous plunge.

With Bitcoin taking a plunge, the wide range of various monetary standards took a plunge, and bunches of individuals lost as long as they can remember investment funds.

In this guide, we are demonstrating how you can teach yourself to make a savvy speculation. Having said that, we should begin with our first exercise.

Approve of Taking Calculated Risks

Since the instability of cryptographic forms of money terribly surpasses that of some other venture class, they are not a typical speculation. Additionally, there is consistently the danger that your nation may ban digital currency exchanging and trade. In the event that that is the situation, at that point you should come to accept not exchanging your crypto assets.So, the significant takeaway here is to just hazard however much cash that you can manage. Like Wence Casares, CEO of Xapo summarizes it in an AMA on Taas stock price

Recall That There are Other Coins

Up until late 2016 Bitcoin was the digital currency, and there was very little other than it. In the event that you needed to put resources into the accomplishment of digital forms of money, you purchased Bitcoin. Enough said. Different cryptographic forms of money – called “Altcoins” – have quite recently been penny stocks on obscure online-markets, generally used to keep excavator’s GPUs working, siphon the cost and dump the coins.

Notwithstanding, this has changed. While Bitcoin is as yet the prevailing cryptographic money, in 2017 it’s a portion of the entire crypto-market quickly tumbled from 90 to around 40%, and it lounges around half as of September 2018.

There are a few explanations behind that. While Bitcoin remains the undisputed lord of digital currencies, numerous individuals have scrutinized its future utility. Right off the bat, there were new and energizing digital forms of money coming out besides, Bitcoin was experiencing serious execution issues and it appeared as though the Bitcoin people group were not even close to taking care of this issue. The square size issue, specifically, was an enormous bone of conflict in the network, which at last prompted the formation of bitcoin money and the separating of the network.

Anyway, the inquiry is, what coins can you conceivably put resources into?

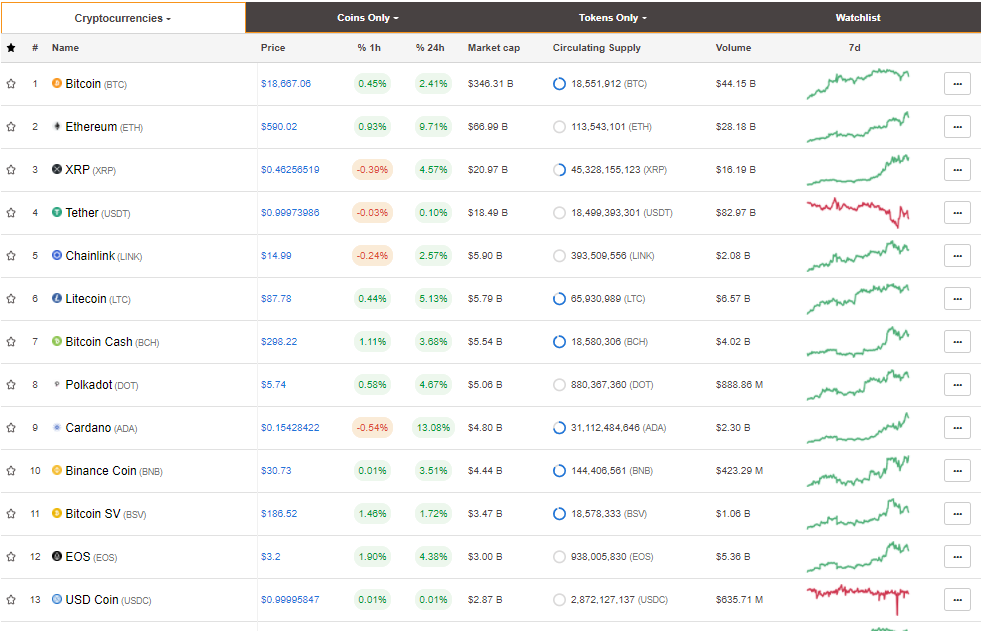

Indeed, for that you will go to digitalcoinprice.com

This site records down digital forms of money in diminishing request of marketcap. Market cap implies the estimation of all token accessible. It’s anything but an ideal measurement, however likely the best we need to perceive the estimation of a cryptographic money.

This is the motivation behind why coinmarketcap is a helpful instrument to have in your grasp.

Consider the Utility That the Coin Is Bringing Into The System

Anyway, you have experienced the market covers and settled on the pack of coins that you needed to put resources into? Great work. In any case, this is the place where the genuine work starts.

The primary thing that you have to do is to peruse their whitepapers. Presently, we comprehend that perusing PDFs may not be the most energizing of things, nonetheless, you totally need to place in the work already before you receive such a rewards.

Perusing the whitepaper itself will give both of you huge advantages:

Right off the bat, you will be more proficient about the coin itself and find out about the utility that it is bringing into the environment.

Also, an ineffectively composed whitepaper is frequently a decent indication of knowing if a venture merits putting resources into. On the off chance that the group itself can’t just clarify the genuine utility of their token, at that point it is likely not worth putting into.

A white paper is the bread and butter of all ICOs. As indicated by Wikipedia.

In easier terms, a white paper can advise potential financial specialists all they require to think about the undertaking. This is the motivation behind why an ICO which doesn’t have a whitepaper ought to just be investigated.

Something else that most ICOs acknowledge is that most of speculators basically won’t try to peruse the whitepaper. This is the motivation behind why they just redistribute their whitepapers to modest independent scholars who wind up making appropriate show-stoppers. “Workmanship” is being utilized amazingly generously here obviously. Look at this diamond of a whitepaper by “Exchange Crypto Trader”.

Here is a concentrate from the whitepaper:

It’s alright, try not to sort out it.

An all around made whitepaper can characterize an age. Simply see what Bitcoin’s whitepaper has done to this time. An ICO which doesn’t try investing any exertion shouldn’t be given any consideration.

Having said that, after you read a fairly composed whitepaper, there are a few choices that you should make.

Check #1: The Value that The Project is Bringing in

Right off the bat, check the undertaking to see whether the coin is getting any genuine utility into the environment. The ideal case of this is Ethereum. There is a motivation behind why it took of so quick, think about the sheer worth that it was acquiring. Unexpectedly, engineers the world over had a stage that they could use to assemble their own dapps on a blockchain.

Alongside that, remember the issues that crypto world is urgently hoping to unravel, mostly: security, versatility, and interoperability. A decent approach to your speculation is to discover the tasks which are explicitly chipping away at taking care of the previously mentioned issues. Here are a portion of the ventures that are hoping to explain every one of the three previously mentioned issues:

Security: Monero, Zcash, Dash

Versatility: OmiseGo, Cardano

Interoperability: AION

Check #2: Does the Project Need Tokens?

All in all, how would you ensure that you are getting acceptable quality tokens?

You review the extend and ask yourself the accompanying inquiries:

Does this venture should be on the blockchain?

Does this venture need to have tokens?

On the off chance that the response for any of those turns out to be “No”, at that point those activities needn’t bother with a token and those tasks are doing an ICO basically to fund-raise. There is an approach to discover the genuine utility of the token.

For this, we will take the assistance of William Mougayar who brings up in his Medium article that there are three precepts to token utility:

Job.

Highlights.

Reason.

These three are secured up a triangle and they resemble this:

Every symbolic job has its own arrangement of highlights and reason which are definite in the accompanying table:

How about we look at every one of the jobs that a token can take up:

Right

By claiming a specific token, the holder gets a specific measure of rights inside the biological system. Eg. by having DAO coins in your ownership, you might have had casting a ballot rights inside the DAO to choose which activities get financing and which don’t.

Worth Exchange

The tokens make an inner monetary framework inside the bounds of the undertaking itself. The tokens can support the purchasers and dealers exchange an incentive inside the biological system. This assists individuals with picking up endless supply of specific undertakings. This creation and upkeep of individual, inward economies are one of the main assignments of Tokens.

Cost

It can likewise go about as a cost entryway with the end goal for you to utilize certain functionalities of a specific framework. Eg. in Golem, you have to have GNT (golem tokens) to access the advantages of the Golem supercomp