A few years ago, telehealth felt temporary. Now it’s simply how many practices operate. Some clients prefer virtual sessions because they feel more comfortable at home. Others rely on them because distance, work schedules, or mobility challenges make office visits difficult.

From a clinical standpoint, most providers have adjusted. From a reimbursement standpoint, the adjustment is still ongoing.

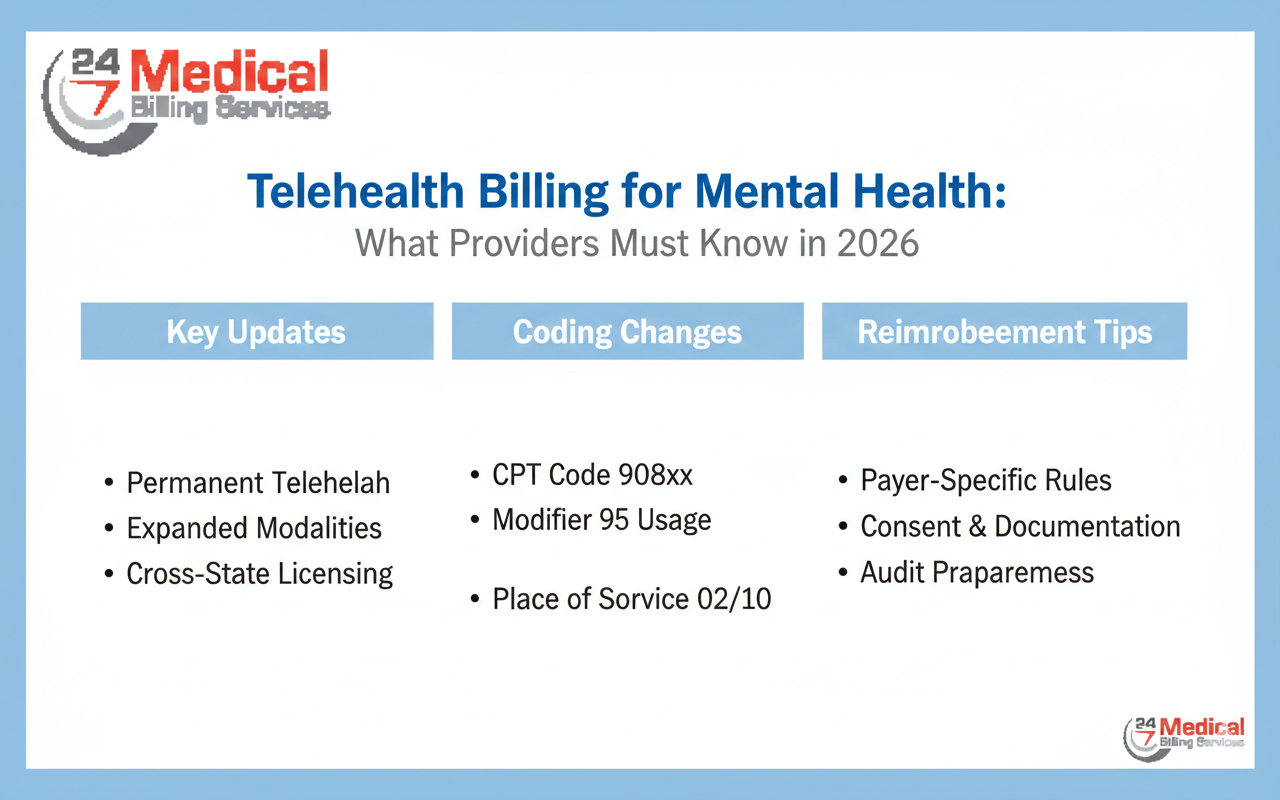

In 2026, insurers are no longer treating telehealth as an exception. It’s part of standard policy now — and that means stricter alignment with coding rules, documentation standards, and benefit limitations. For practices, this has made telehealth an important component of mental health billing, not just a scheduling option.

The Assumption That Causes the Most Problems

One of the most common mistakes is assuming a virtual session bills exactly the same way as an in-person visit.

It doesn’t.

The CPT code may remain the same, but the surrounding details often differ. Place-of-service indicators matter. Modifiers matter. In some cases, reimbursement rates differ depending on how the service is reported.

Claims systems flag inconsistencies quickly. A missing modifier or incorrect service location can delay payment before anyone even reviews the clinical note.

If you want a clearer picture of what insurers currently expect, reviewing the latest tele-mental health billing requirements can help clarify CMS and commercial payer updates that affect 2026 claims.

Coverage Isn’t Always Equal

Another issue surfaces during eligibility verification.

Just because therapy is covered does not mean telehealth therapy is covered in the same way. Some plans reimburse virtual visits at parity. Others apply different copays. A few impose restrictions tied to diagnosis or provider credentials.

These differences are easy to miss if eligibility checks stop at “active coverage.”

When coverage assumptions are wrong, the issue usually appears weeks later in the form of partial payments or denials. By then, the session has already taken place, and reversing the situation may require appeals.

Careful verification upfront prevents uncomfortable conversations later.

Documentation Is Getting More Specific

Telehealth documentation expectations have become clearer in 2026.

Insurers increasingly expect notes to reflect that the encounter occurred virtually. That includes confirming real-time audio and video interaction when required, along with standard clinical elements such as assessment and treatment planning.

This doesn’t mean writing longer notes. It means writing clearer ones.

When documentation fails to reflect how care was delivered, it creates risk during audits even if the clinical service itself was appropriate.

Over time, consistent documentation practices not only reduce denials but also make outsourcing mental health billing more effective, since external billing teams rely heavily on accurate clinical records to submit clean claims and defend them when necessary.

Authorizations Are Quietly Reappearing

During earlier periods of expanded access, some authorization rules were relaxed. Many payers have since returned to more structured requirements.

Certain plans now require approval after a defined number of telehealth visits. Others apply separate authorization standards for virtual care.

If visit counts aren’t monitored carefully, denials can appear without warning. And once denied for lack of authorization, claims are difficult to correct retroactively.

The safest approach is tracking telehealth visits with the same attention given to in-person treatment plans.

The Revenue Impact Is Subtle at First

Telehealth billing issues rarely create immediate chaos. Instead, they accumulate.

A few claims take longer to process. A handful require resubmission. Payments arrive slightly reduced. Staff spend more time checking payer portals.

Individually, these events seem manageable. Collectively, they affect cash flow and administrative workload.

Practices often realize there’s a pattern only after accounts receivable begins stretching beyond normal timelines.

That’s why telehealth oversight needs to be proactive rather than reactive.

Looking Ahead

Telehealth is not disappearing. Patients value it. Providers rely on it. It has reshaped access to care in ways that are unlikely to reverse.

But in 2026, success depends on treating telehealth reimbursement as its own discipline within mental health billing.

That means:

- Verifying benefits specifically for virtual services

- Applying correct service location indicators

- Using required modifiers consistently

- Maintaining documentation that clearly reflects how care was delivered

When these pieces align, telehealth becomes financially sustainable rather than administratively frustrating.

Conclusion

Virtual care has become a permanent part of behavioral health delivery. It offers flexibility, expands reach, and reduces barriers for many patients.

At the same time, payer scrutiny has increased. Telehealth claims now operate under defined rules rather than temporary allowances. Small billing inconsistencies can lead to delayed or denied payments.

Practices that adapt their mental health billing processes to reflect updated telehealth standards will remain stable as policies continue evolving. Those that rely on outdated assumptions may find themselves spending more time correcting claims than providing care.

Telehealth works best when clinical quality and billing accuracy move together. In 2026, that balance is no longer optional it’s essential.