To Change Or Update State Unemployment Insurance Rate In QuickBooks Payroll subscribers must update their state unemployment coverage (SUI) costs in QuickBooks themselves. Many states send those fees to employers after the new year, however, the costs can be retroactive to the beginning of the yr (see chart). The QuickBooks Payroll tax desk does not include updates to those costs, because states assign every corporation a unique rate based on their employment records. Employers located in states that have kingdom incapacity insurance (SDI) may additionally need to update their SDI quotes themselves.

Observe those commands for updating your fees and making legal responsibility modifications in QuickBooks.

To update your State Unemployment Insurance Rate or SDI quotes in QuickBooks:

- From the employee’s menu, select Payroll object listing.

- Pick your SUI or SDI payroll object.

- Click the Payroll item at the bottom of the listing and click the Edit Payroll object.

- Click on next till you spot the tax fee window.

- Input your new rate or costs (input this in percentage form, like 4% and no longer .04).

- Click on next until you may click on end.

- In case your state sends your rate change notice earlier than the tax submitting due date, and the trade is retroactive to the start of the yr or the sector:

Trade the charge in QuickBooks (before strolling your subsequent payroll).

If you may be going for walks payroll inside the current zone, QuickBooks will self-alter your payroll tax for rate increases the use of the price entered at the payroll item (from step 1, above, trade the fee in QuickBooks). If the fee decreased, you’ll see much less or no tax calculated to alter for the difference.

Or

Input tax modifications for every State Unemployment Insurance Rate employee (if applicable) for the affected period. (For unique commands, see the subjects “going for walks the Payroll Checkup” and “Adjusting the liability stability for payroll items” in QuickBooks assist.)

In case your country sends your price change notice after the tax submitting due date and the change is retroactive to the start of the yr:

Trade the fee in QuickBooks (before strolling your subsequent payroll).

Input tax changes for each employee (if relevant) for the affected intervals. (For certain instructions, see the topics “jogging the Payroll Checkup” and “Adjusting the legal responsibility stability for payroll items” in QuickBooks help.)

In case your SUI fee changed, you may want to record a change and pay additional taxes due. Your moves will rely on what your kingdom requires.

Notice: If payroll became processed previous to getting into any tax adjustments (step 2, just above) in a quarter after the rate exchange becomes made, QuickBooks State Unemployment Insurance Rate will self-modify within the region the assessments are dated. If the rate is multiplied, you’ll see additional taxes calculated. If the price decreased, you will see less or no tax calculated to adjust for the distinction.

Read more: Problems signing in to QuickBooks Online?

Quick Tip: For greater statistics approximately state unemployment coverage costs, see the QuickBooks.

it’s first-rate to look you’re publishing today, sharp auto.

Adjustments made at the SUI costs in QuickBooks online (QBO) apply in your future transactions most effectively.

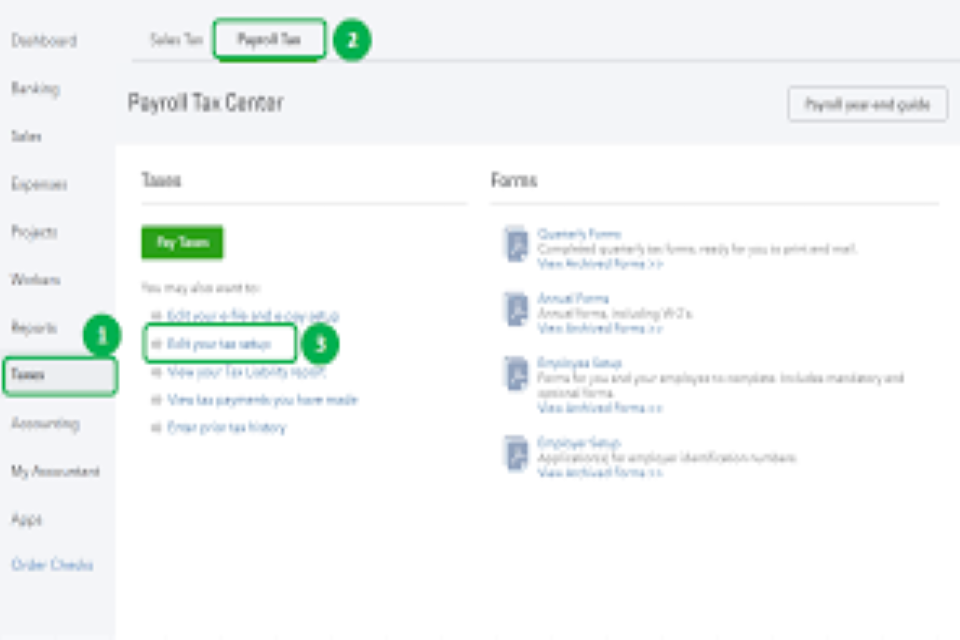

Here’s a way to replace SUI price:

- Visit the tools icon.

- Beneath Your organization, click on Payroll Settings.

- Pick country Tax.

- Scroll right down to the country Unemployment coverage (SUI) Setup phase.

- Pick out change or add a new rate.

- Seek advice from your word from your nation and input your new rate. If the rate is provided as a decimal, you should input it as a percent. (for instance, enter 3.Four% now not .034).

- Input the effective Date provided in the be aware from your kingdom.

- Click adequate

If converting the charge has caused a tax over-fee, I suggest contacting your state’s unemployment department to affirm the quantity overpaid, and the way you would like you to apply for the credit. For greater information, test out this text: update your kingdom Unemployment insurance (SUI) fee in State Unemployment Insurance Rate or Intuit Payroll

As soon as you have got spoken with your kingdom, please touch our QuickBooks Care team. They could help you in for assistance. Right here’s how you can attain us:

- Visit the assist menu on the higher proper.

- Pick out touch Us.

- Input your challenge.

- Click on allow’s communicate.

- Select to Get a callback.

- Kind on your touch information.

- Pick affirm my name.

For more information about theState Unemployment Insurance Rates in Quickbooks.